The challenge is that companies commonly take into account climate-change threats to their assets and operations. But they are less proactive about considering risks that climate-change policies pose to their strategy and returns.

One of the possible solutions is predicting that those policies will extract a growing price for firms carbon emission. More and more companies are setting a monetary value on their own emissions to help them evaluate investments, manage risk, and develop strategy.

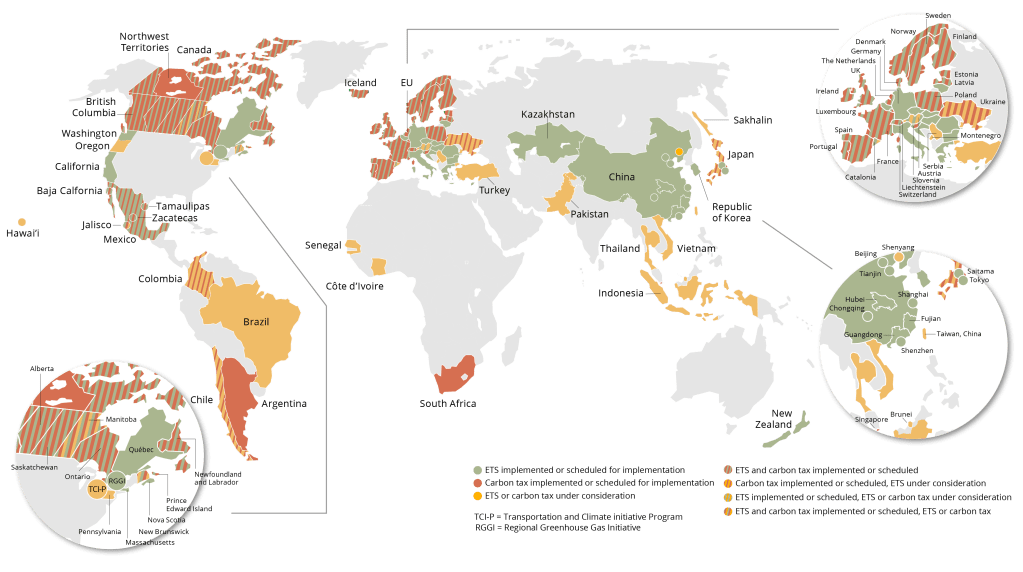

Companies must forecast future carbon prices in the jurisdictions where they do business and then set an internal carbon price (ICP) that reflects their emissions and the likely trajectory of carbon prices set by governments. A carefully calculated ICP can position a firm for future regulation and help It gain long-term advantage.

By setting an internal carbon price (ICP), companies can prepare for uncertain external pricing in the future, and investors can get a clearer picture of a firm’s ability to compete in a low-carbon world.