The global sustainability regulatory landscape is entering a new phase of consolidation, divergence, and transition. Across Europe, the UK, the Americas, and Asia Pacific, governments and regulators are tightening expectations around climate risk, due diligence, stewardship, and sustainable finance. Yet, each region is doing so at a different pace and with varying degrees of prescriptiveness. The result is a complex compliance environment in which multinational companies must navigate both increasing standardisation and persistent regulatory fragmentation.

Europe and the UK: From Ambition to Calibration

Europe remains the most advanced and comprehensive jurisdiction for sustainability regulation, spanning corporate disclosure, due diligence, banking supervision, fund labelling, and sustainable finance instruments. The European Commission’s suite of regulations, including the CSRD, CSDDD, EU Taxonomy, SFDR, and the EU Green Bond Standard, has set a global benchmark for investor-grade sustainability reporting and climate-aligned financial markets.

However, Europe is now entering a phase of regulatory recalibration. Through its Omnibus Proposal, the Commission is responding to industry concerns over complexity, cost, and readiness. CSRD and CSDDD scopes may contract by up to 80 percent, assurance timelines are expected to be relaxed, and due diligence obligations may be narrowed to direct suppliers. Similarly, the EU Taxonomy may adopt materiality thresholds and fewer DNSH requirements, signalling a shift from over-prescriptive rules toward more pragmatic implementation.

Financial market rules continue to strengthen through enhanced Pillar 3 ESG disclosures, MiFID II sustainability preferences, fund naming guidelines, and the Low Carbon Benchmark Regulation. All aim to reduce greenwashing and align investment flows with climate objectives. The EU Green Bond Standard, effective from late 2024, will test issuer capability to meet high taxonomy thresholds and strict assurance requirements.

The United Kingdom, outside the EU framework, is converging toward global standards through its Sustainability Disclosure Requirements, climate risk governance expectations, and forthcoming ISSB-aligned UK Sustainability Reporting Standards. With anti-greenwashing rules, fund labels, TCFD-aligned disclosures, and strengthened stewardship codes, the UK is positioning itself as a global centre for credible sustainable finance while maintaining regulatory independence.

Americas: Patchwork Progress and State-Level Leadership

Regulation in the United States remains fragmented. The SEC’s ESG fund disclosure rules have advanced transparency for investment products, yet the broader SEC climate disclosure rule is stalled amid political and legal contention. In this vacuum, California has emerged as a powerful subnational regulator. Its SB 253 and SB 261 laws impose some of the world’s most stringent mandates on Scope 1, 2, and 3 emissions reporting and climate risk disclosure for companies with more than USD 1 billion in revenue, creating de facto national obligations for many large firms.

Prudential regulators, including the Federal Reserve, OCC, and FDIC, are gradually embedding climate risk management into supervisory expectations for banks, signalling slow but steady institutionalisation of ESG risk within the financial system.

Canada is moving toward full alignment with ISSB (CSDS 2) standards, with forthcoming mandatory climate disclosures for public companies, enhanced stock exchange guidance, and climate risk governance expectations under OSFI’s Guideline B 15. In Latin America, momentum is accelerating. Brazil, Mexico, and several other markets are transitioning from voluntary expectations to mandatory ISSB aligned reporting by 2026, supported by phased assurance requirements and growing investor demand.

Asia Pacific: Rapid Alignment with ISSB and Transition to Mandatory Regimes

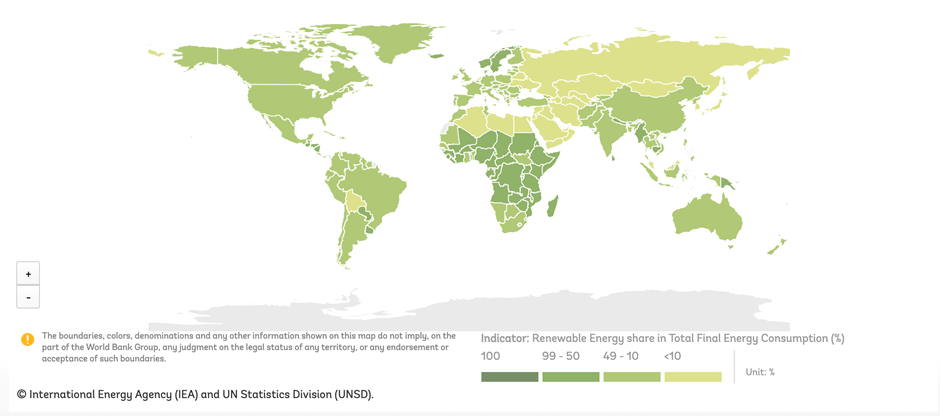

The Asia Pacific region is shifting from fragmented voluntary practices toward a coordinated move to ISSB-aligned mandatory disclosure.

Hong Kong and Japan are among the earliest markets to require ISSB-based climate reporting, building on strong TCFD foundations. Japan is concurrently advancing climate governance through revisions to the Corporate Governance Code and enhanced stewardship expectations.

Australia’s 2024 climate reporting law marks one of the fastest transitions to mandatory ISSB-aligned disclosure, with Scope 1 and 2 reporting required from 2025 and Scope 3 from 2026.

In Southeast Asia, regulators are accelerating reforms:

- Malaysia is transitioning all Main Market issuers to ISSB-aligned sustainability statements by 2025 to 2026, with assurance requirements added over time.

- Singapore will begin its phased ISSB regime from FY2025, with Scope 1 and 2 mandatory for listed issuers and assurance expected from the middle of the decade.

- Indonesia, Thailand, and the Philippines are strengthening their frameworks, guided increasingly by global baselines and emerging regional taxonomies.

India and China represent two of the largest markets undergoing structural regulatory evolution. India’s mandatory BRSR reporting for the top 1,000 listed companies is expanding, and new rules for ESG rating providers signal rising regulatory scrutiny. China’s new Sustainability Disclosure Standards (Trial) and its 2024 application guides mark the beginning of a phased transition toward mandatory ESG reporting across major exchanges by 2027 to 2030, including features such as double materiality and value chain disclosures.

South Korea is expected to fully align with global standards by 2030, with climate risk integration expanding across its prudential supervisory regime.

Middle East and Africa: Sovereign Wealth Funds Driving Market Discipline

In the Middle East, regulatory momentum is increasing, driven heavily by sovereign wealth funds such as PIF, ADIA, Mubadala, and QIA, which increasingly require strong ESG credentials from their investees. Stock exchanges in Saudi Arabia, the UAE, and Qatar encourage sustainability disclosure, and more formalised ESG requirements are expected as these markets expand sustainable finance instruments.

In South Africa, the JSE, King IV Code, and the Prudential Authority’s Climate Roadmap together embed ESG governance, integrated reporting, and climate risk management into corporate expectations. Anticipated future alignment with ISSB standards will further strengthen comparability and investor confidence.

Conclusion: Toward a Fragmented but Converging Global Baseline

Across all regions, the direction of travel is unmistakable: clearer standards, broader disclosure mandates, stronger assurance, and deeper integration of climate risk into financial supervision. The ISSB standards (IFRS S1 and S2) are rapidly becoming the de facto global baseline, even as Europe pursues a broader double materiality model and the United States remains politically divided.

The next two to three years will define the global regulatory equilibrium. Companies operating internationally must prepare for:

- Convergence around ISSB for climate-related disclosures

- Increasing due diligence expectations, although calibrated in Europe

- Stronger anti-greenwashing regimes across capital markets

- Expanding assurance obligations

- More prescriptive stewardship and governance requirements

- Sovereign wealth funds and stock exchanges serving as new enforcement centres

The global ESG regulatory landscape is no longer emerging. It is crystallising. Firms that invest early in data architecture, credible transition planning, and integrated reporting will be best positioned to meet rising expectations, secure capital, and maintain legitimacy across jurisdictions.